Corporate banks have provided quite stable returns in recent years, but today they faced daunting challenges, especially during the COVID-19 and quarantine period.

The status quo and existing conditions of retail banking were already tottering. Banks that are already under siege with new technologies, new consumer expectations, new competitors, and new regulations are now trying to cope with the rapid adaptation processes.

Banks and credit unions have now had to change their business models, prioritize investments, increase their innovation efforts by completely changing the products and services offered. They had to quickly find relevant tools and adapt them to maintain their success and sustainability. In addition to that, while the importance of digital channels increases with pandemics, distribution options need to be reconsidered.

Trends That Will Shape the Bank of the Future

In the past, the main driving force for changes in the banking strategies was seen only as changes in consumer behavior. But today, new innovations such as artificial intelligence, machine learning, blockchain, the Internet of Things, and other technologies supported by data and advanced analytics have been added to the main driving forces of this rapid change.

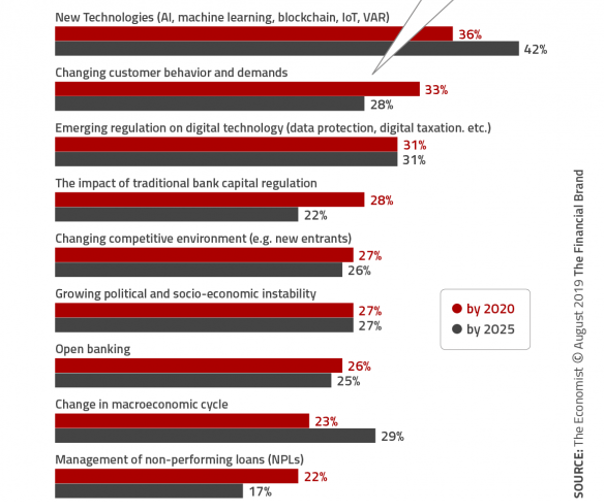

According to the research conducted by The Economist Intelligence Unit with 405 global banking executives, the predictions of the respondents are that the importance of new technologies and regulations regarding data technology will increase in the future (2020-2025).

According to the research report, the areas where retail banks focus on their priorities, and digital investments can be listed as follows:

- Four out of ten banks are aware that business models are turning into a digital ecosystem, so open banking is seen as a real opportunity

- Three out of every five respondents expect banks to use more computing power in the public cloud by 2025 than they currently use in all private cloud data centers;

- New technologies such as artificial intelligence, machine learning, and blockchain have replaced the changing customer behavior and demands as the main driving force of strategic thinking in banks around the world in the short (36%) and longer-term (42%).

You can examine the trends, that will shape the bank of the future, determined as a result of the research below:

Adapting to the Future

Corporate banks are now required to offer a more prominent value proposition based on their expertise, data, and strong relationships to maintain their market shares and expand their income pool. For this, while using technology and providing better service to their customers, they should also determine their roles in ecosystems.

According to McKinsey, four areas of transformation are important for corporate banks. We can list them as follows:

1. Banks should digitize their processes end-to-end

By building customer-centric digital journeys, redefining IT and operating models, placing innovative technologies in the value chain, and industrializing core production, banks can increase customer satisfaction and reduce costs.

2. Creating advanced analytics DNA

Banks need to maximize their focus on the customer by improving data governance and infrastructure, creating advanced analytical capabilities, increasing usage scenarios, and following continuous improvement.

3. Strengthening customer relationships with differentiated multi-channel coverage

To combat brokerage, banks should strengthen customer relationships using differentiated multi-channel coverage, need-based segmentation, and industry-specific value recommendations. Relationship managers in banks need support to develop new skills to deliver better services to high-value customers.

4. Redefining the product offering

Banks should create cross-product platforms, move non-differentiating products to these platforms, seamlessly integrate with customer value chains, and provide value-added services in response to commodification and convergence of flow and credit products.

In addition, financial service providers must demonstrate that they can ethically use new technologies such as artificial intelligence and big data. In addition to ensuring the consent of their regulators or investors, it is also important that they communicate with customers clearly and give them meaningful options about the use of their information.

To provide all this, the formula that the future bank will need is quite simple and consists of four components that are considered “ABCD of Future Banking”:

A – Artificial Intelligence

B – Big Tech

C – Core Banking & Cloud

D – Digital Assets

Now is the Time for Transformation

Technology has the potential to offer tremendous speed and convenience to the banking and finance industry. But banks and financial services that will be successful in the future and lead the competition are those that will match the best technology with thoughtful risk management and above all, excellent customer experiences.

ForInvest enables you to lead the trends in the digital transformation process accelerated in the financial sector with the COVID-19 period and meet your customers’ needs and offer them the most perfect experiences. Foreks’s FinTech Solutions are developed by more than 30 years of financial software development knowledge and a team of experts ready to lead the next digital evolution.